Tariffs, Trade Tensions, and the CUSMA Review: What Lies Ahead for Canada –U.S. Trade

After a turbulent period for North American trade, tariff policy between Canada and the United States has settled into a narrower—but still impactful—set of measures. With metals and automotive tariffs remaining in force, markets are now turning their attention to the next major inflection point: the upcoming Canada–United States–Mexico Agreement (CUSMA) review. The outcome of this process will have meaningful implications for supply chains, investment decisions, and the broader stability of Canada–U.S. trade relations.

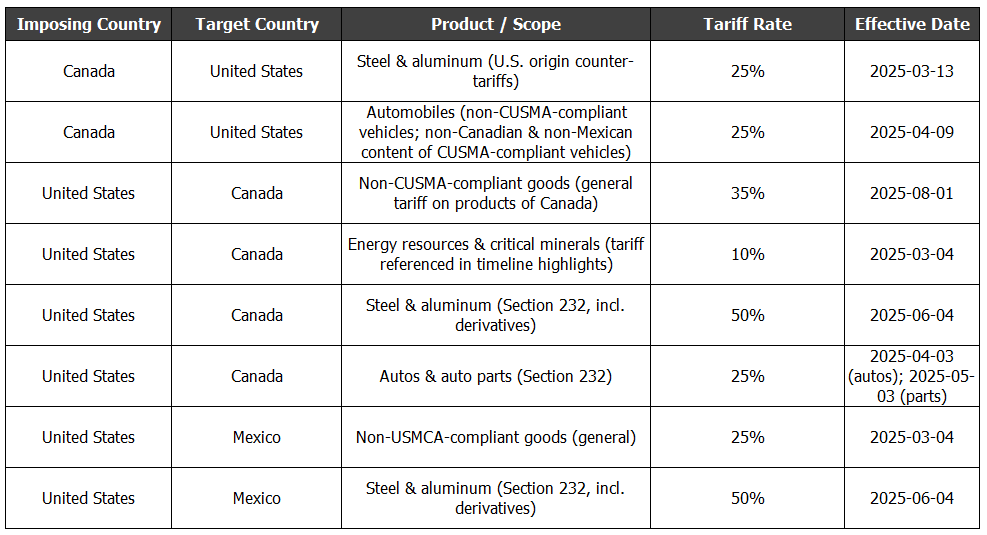

Although Canada and the United States have stepped back from the broad retaliatory tariffs introduced in early 2025, significant measures remain in force in a small number of strategically important sectors. Most notably, the United States continues to apply Section 232 tariffs of 50% on steel and aluminum imports from Canada, following an increase from 25% in June 2025. In addition, 25% tariffs remain in place on automobiles and certain auto parts that do not meet CUSMA requirements. In response, Canada has maintained 25% retaliatory tariffs on U.S. steel, aluminum, and automobiles, even as it removed tariffs on most other U.S. goods effective September 2025. The persistence of these measures is particularly notable because steel and aluminum are covered under CUSMA and would ordinarily trade tariff‑free; however, the U.S. has not provided a CUSMA exemption for its Section 232 tariffs. As a result, Canada has explicitly tied the continuation of its own counter‑tariffs to the U.S. decision to maintain these sector‑specific duties, leaving key industrial supply chains exposed to ongoing trade friction despite the broader free‑trade framework.

Selected Tariffs in Force Between Canada, the United States (as of February 2026)

The CUSMA is the governing framework for trade across North America, having entered into force in July 2020 as the successor to NAFTA. It covers a highly integrated economic region of roughly 500 million people and underpins nearly $2 trillion in annual trilateral trade. While the agreement preserved the core principle of tariff‑free trade across most goods, it also updated the rules to reflect modern trade realities, including digital commerce, intellectual property, and labour and environmental standards. Importantly, CUSMA was negotiated with the explicit goal of maintaining supply‑chain integration while providing greater certainty and enforceability for all three parties, particularly in strategically sensitive industries such as manufacturing and autos.

Unlike earlier trade reviews, the upcoming 2026 CUSMA review in June carries structural significance due to the agreement’s built‑in term‑extension mechanism. Under this framework, the parties must jointly assess the agreement six years after implementation and decide whether to extend it for an additional 16‑year term. Failure to reach consensus does not immediately terminate CUSMA, but it introduces rolling annual reviews and materially increases long‑term uncertainty. This timing coincides with a period of heightened trade enforcement, increased use of national‑security‑based tariffs, and growing geopolitical tension, making the review a pivotal moment for the future stability of North American trade. As a result, the process is likely to be less procedural and more strategic than past reviews, with higher stakes for governments, investors, and supply chains.

Several friction points are likely to feature prominently in the review discussions. Steel and aluminum sit at the forefront, as U.S. national‑security tariffs have effectively overridden tariff‑free treatment envisioned under CUSMA, prompting Canada to maintain retaliatory measures and push for stronger safeguards against unilateral actions. Automotive rules of origin also remain sensitive, particularly as policymakers reassess content thresholds, enforcement practices, and the balance between industrial policy and free trade. Beyond sector‑specific issues, trade enforcement and national security tools—including the use of emergency powers and Section 232 authorities—have exposed vulnerabilities in CUSMA’s ability to constrain unilateral measures. Finally, political timing and leverage will shape the negotiations, as concerns over non‑party countries gaining indirect access to North American markets, particularly through manufacturing and investment patterns in Mexico, may lead the United States to seek tighter origin verification and supply‑chain scrutiny. Together, these issues suggest the 2026 review will test not only the limits of CUSMA’s legal framework, but also the willingness of the parties to recommit to its underlying principles.

At the Cash Management Group, we continue to analyze central bank developments and their implications for clients. By staying ahead of policy shifts and maintaining a flexible, data driven approach, we help institutional and private clients navigate evolving market conditions with confidence.

If you would like to discuss how these developments could affect your portfolio, please contact us at 604.643.0101 or cashgroup@cgf.com.

Book a meeting today with our of our advisors: https://calendly.com/cashgroup-cgf

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!