Central Banks Hit Pause: Insights from Today’s Rate Decisions

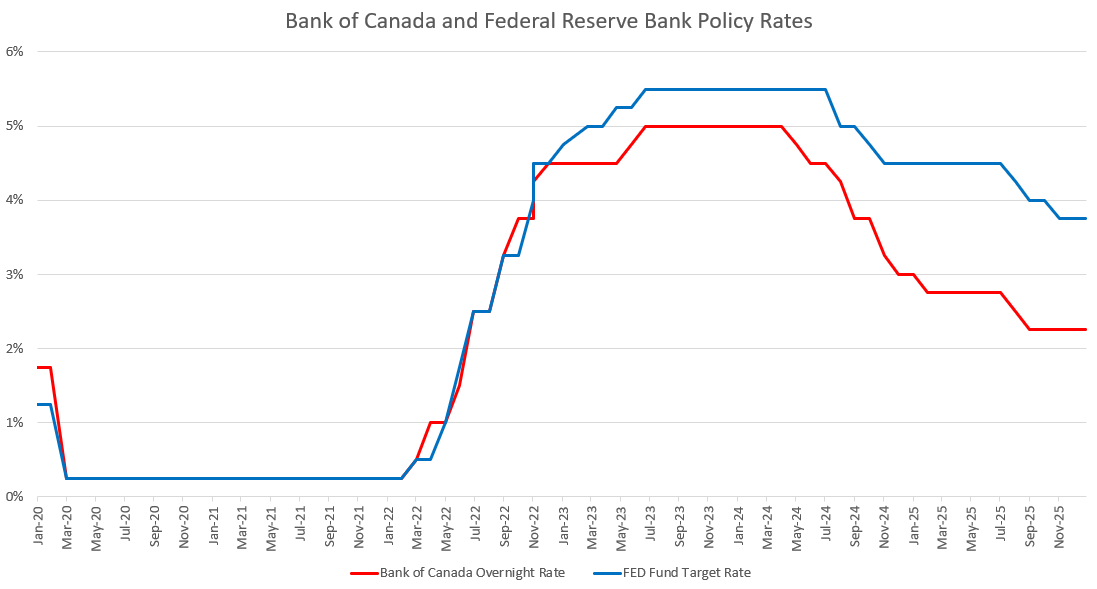

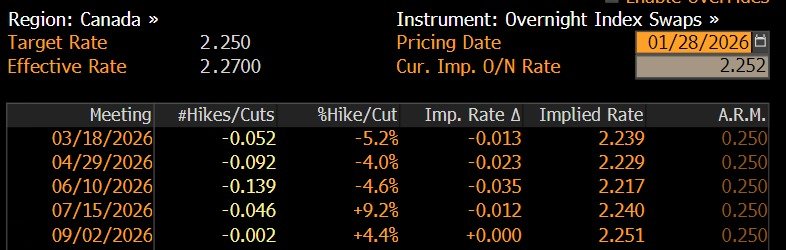

The Bank of Canada kept its policy rate at 2.25% today, choosing a steady approach as the economy continues to adjust to last year’s slowdown and the uncertainty surrounding U.S. trade policy. Inflation rose to 2.4% in December from 2.2%, but most of that increase came from last year’s temporary GST/HST holiday dropping out of the comparison. When those base effects are removed, underlying inflation continues to cool and is now much closer to the Bank’s 2% target. At the same time, the labour market remains soft. The unemployment rate is still elevated at 6.8%, driven largely by a rise in new labour‑force entrants at a time when job growth remains weak. The Bank noted that while Canada posted a solid third quarter, growth likely stalled in the final months of the year, and broader risks, including tariff uncertainty and the upcoming CUSMA review, continue to weigh on the outlook.

In the United States, the Federal Reserve also left interest rates unchanged, holding the federal funds target range at 3.50% to 3.75%. The tone of the announcement was cautious, reflecting an economy where inflation is proving slow to move lower and the labour market is showing clearer signs of cooling. December inflation held steady at 2.7%, and core inflation remained at 2.6%. Job growth has slowed, with most gains concentrated in service sectors, while hiring in many other areas is losing momentum. Despite these signs of strain, overall performance remains stronger than expected. Third‑quarter GDP was revised up to 4.4%, the fastest pace in two years, due to strong consumer spending and AI-related investments. Even so, the composition of that strength raises questions about its durability. A recent Moody’s analysis shows that the top 10% of earners now account for roughly half of all consumer spending, the highest share on record. This concentration has supported growth but also creates vulnerability if higher‑income households reduce spending.

Source: FRED: Data from 01/01/2020 – 01/28/2026 and Statistics Canada: Data from 01/01/2020 – 01/28/2026

Today’s Federal Reserve decision also came during a period where the institution is facing unusual scrutiny. The central bank is managing legal and political challenges, including attempts to remove a current Governor and an ongoing investigation involving Chair Powell. These tensions have brought renewed attention to the importance of Fed independence. This theme aligns with comments made today by Bank of Canada Governor Tiff Macklem, who highlighted that a credible and independent Federal Reserve is essential not only for the United States but also for global financial stability. With policy decisions now dependent on small shifts in inflation and employment data, clarity and independence from both central banks play a key role in maintaining confidence.

These dynamics have also influenced currency markets. Over the past several months, the traditional safe‑haven appeal of the U.S. dollar has softened as investors respond to geopolitical risks, fiscal concerns, and narrowing interest‑rate differentials. As confidence in the dollar’s role has eased, investors have increased their hedging activity and allocated more to alternative safe‑haven assets such as gold. This shift has provided some support to the Canadian dollar, which has recently traded above 72 U.S. cents. Even so, Canada’s currency remains sensitive to changes in U.S. tariff policy or shifts in rate expectations. For the Bank of Canada, these external developments continue to shape the policy outlook, especially given how exposed Canada is to U.S. demand.

Source: CADUSD FX Rate - Refinitiv - 6-Month Historical Chart

Looking ahead, both central banks appear likely to remain patient. For the Bank of Canada, future decisions will depend on continued progress in core inflation and clearer signals on the external environment. For the Federal Reserve, the timing of eventual rate cuts will hinge on whether inflation shows more convincing downward movement and whether labour‑market softness becomes more pronounced. With both economies facing structural pressures, from Canada’s trade exposure to the increasingly narrow base of consumer spending in the United States, the coming months will be important in determining how policy evolves.

At the Cash Management Group, we continue to analyze central bank developments and their implications for clients. By staying ahead of policy shifts and maintaining a flexible, data driven approach, we help institutional and private clients navigate evolving market conditions with confidence.

World Interest Rate Probability - Source: Bloomberg - January 28, 2026

If you would like to discuss how these developments could affect your portfolio, please contact us at 604.643.0101 or cashgroup@cgf.com.

Book a meeting today with our of our advisors: https://calendly.com/cashgroup-cgf

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!