Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market updates, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!

Sort by Date

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- November 2021

- September 2021

- June 2021

- March 2021

- January 2021

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

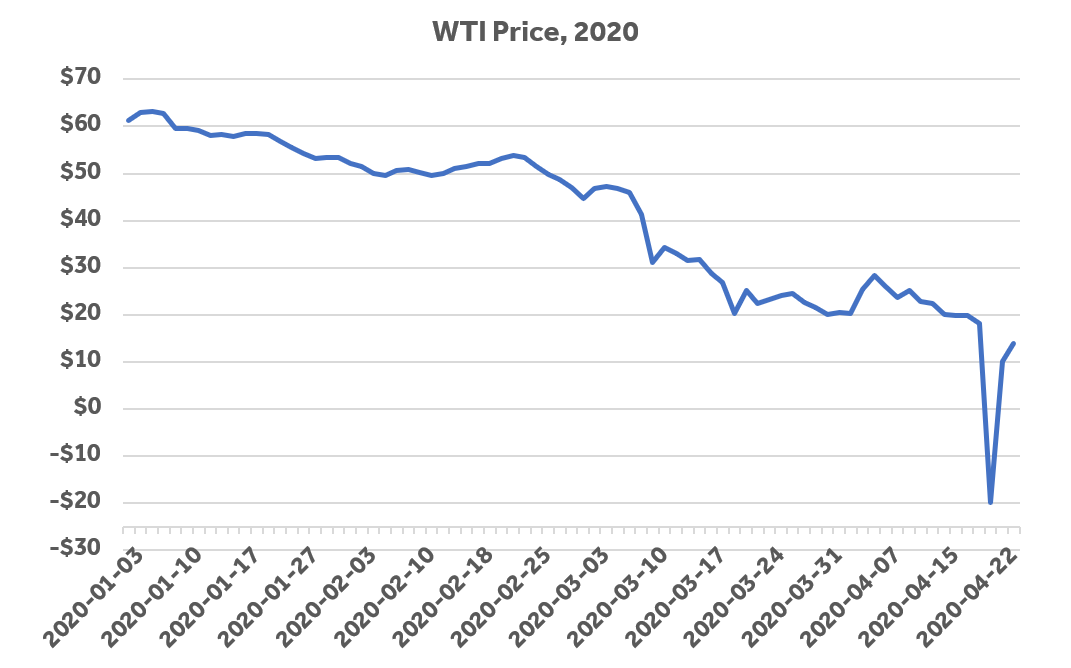

Oil Down 20%; DOW Over 24,000

Today's trading continued last weeks light gains, with the Dow Jones Industrial Average closing above 24,000 for the second time since March 10th. Volatility in WTI oil continued apace, as the price of June WTI contracts declined more than 20%, but Brent Crude closed down 6.3%.

Who Does Well in a Recovery?

Today's trading lacked the sizzling action of previous weeks, although that's likely a welcome change. The Dow Jones Industrial Average closed up 1.1%, the S&P/TSX Composite gained 1.2%, and the price of oil (Brent crude, to be precise) added 2.4% after a wild week, closing down 22% from last Friday.

Oil Price Rallies From Historic Lows

Today's trading saw a lift in global equity markets, with the Dow Jones Industrial Average increasing by over 500 points and the S&P/TSX Composit closing up 2.4%. The real story, of course, was oil, which rebounded sharply, with the price of WTI closing up 20%.

What Does a Negative Oil Price Mean?

Today's headlines were dominated by a paradoxical piece of news: the price of oil has gone negative, briefly reaching -$37/barrel USD. But what does that actually mean? How is the price of oil measured? Can I buy all the oil in the world and lock in an enormous profit? What does this mean for the economy, in the near, intermediate, and long term? And why does this all revolve around Cushing, Oklahoma?

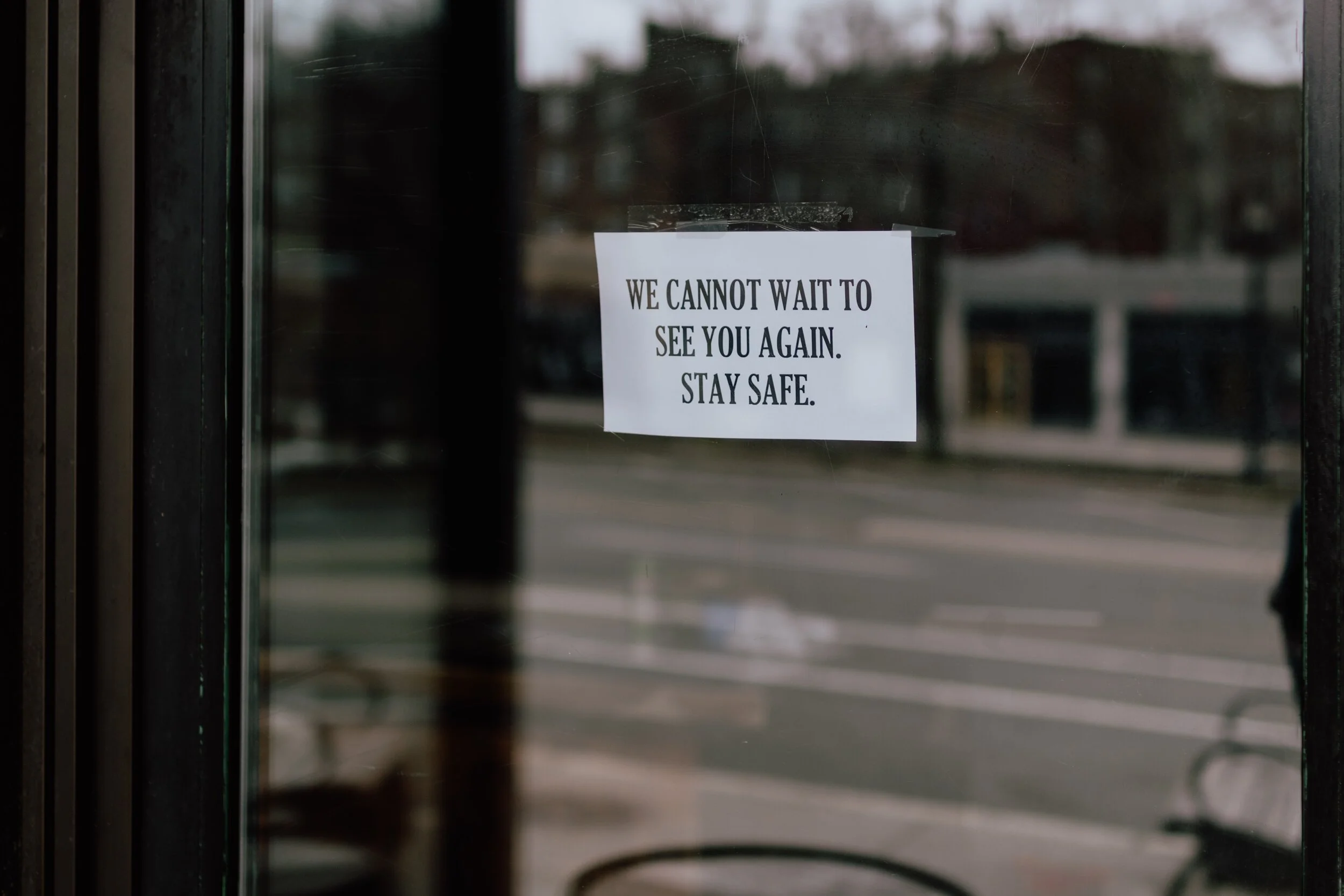

5.2 Million More Americans File For Unemployment

Today was a quiet day in the markets, and the first double (not triple) digit move in the Dow Jones Industrial Average in weeks. Today's trading followed the release of US initial jobless claims data, which indicated that 5.2 million Americans filed for unemployment last week.