Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market updates, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!

Sort by Date

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- November 2021

- September 2021

- June 2021

- March 2021

- January 2021

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

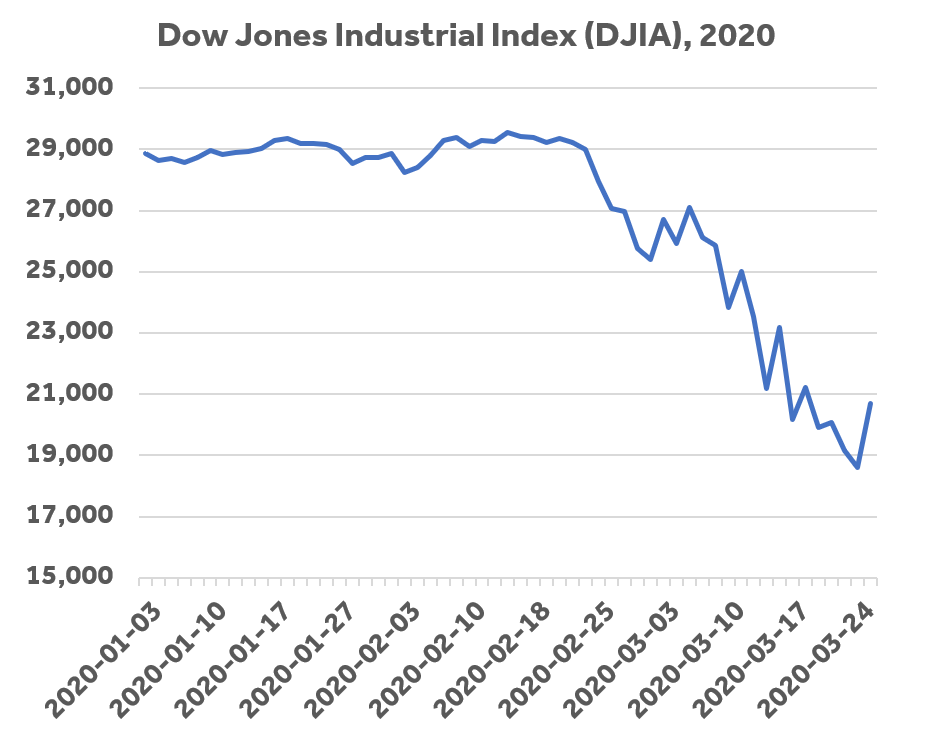

Have We Reached the Bottom, or is a Dead Cat Bouncing?

This market rally could be a "relief" rally, or a headfake rally, the proverbial "dead cat bounce", or genuinely the capitulation point that the bull market to come will be referenced against. Which is it?

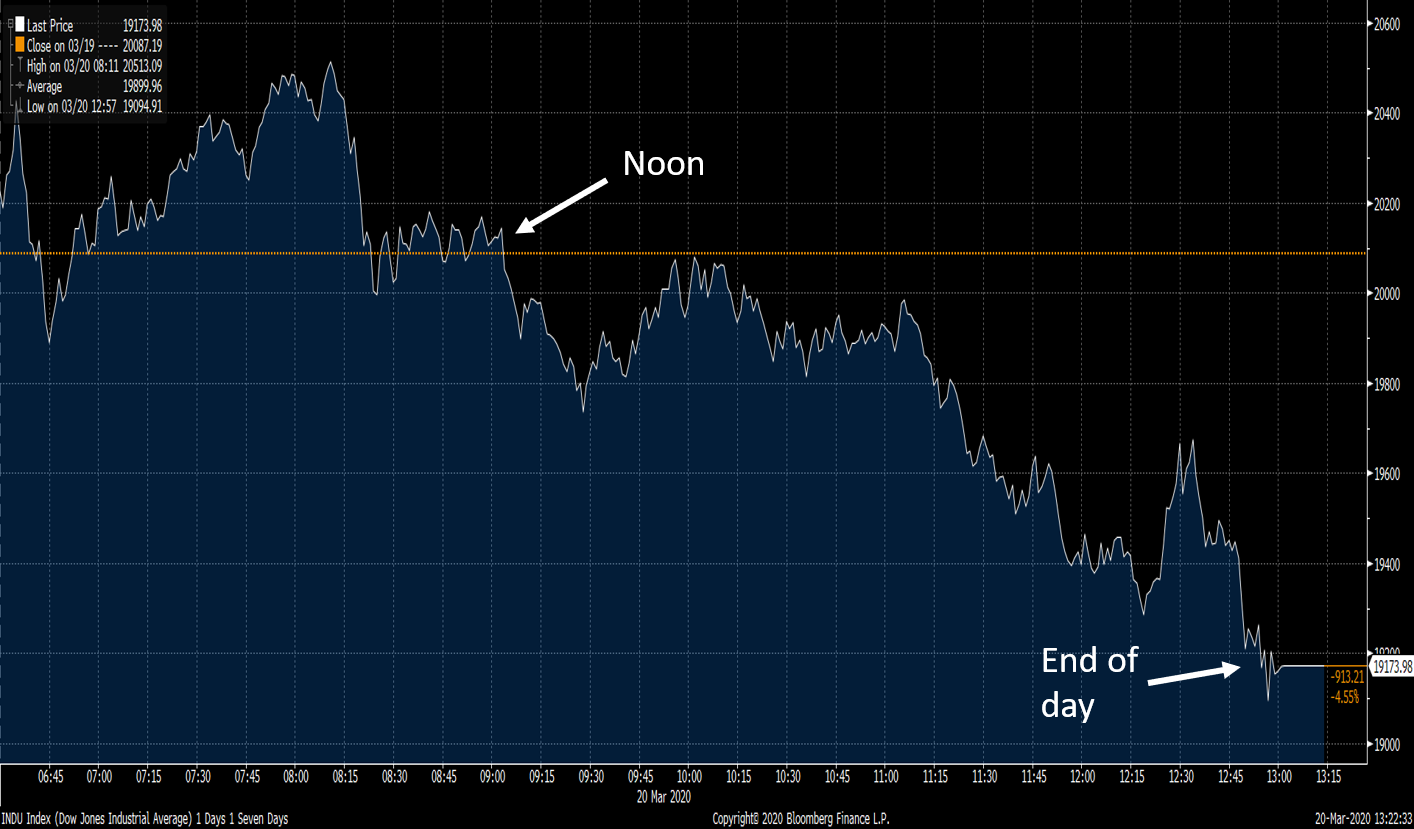

Stocks Plunge Heading Into Weekend

If you tuned out of the market at noon, you should check your portfolio again. After a calm morning, traders around the world decided that they need to risk-off for the weekend. You can understand the logic: two days is approximately twelve and a half years in today's market. Remember that it wasn't long ago that the Fed met on a Sunday to cut rates to zero.

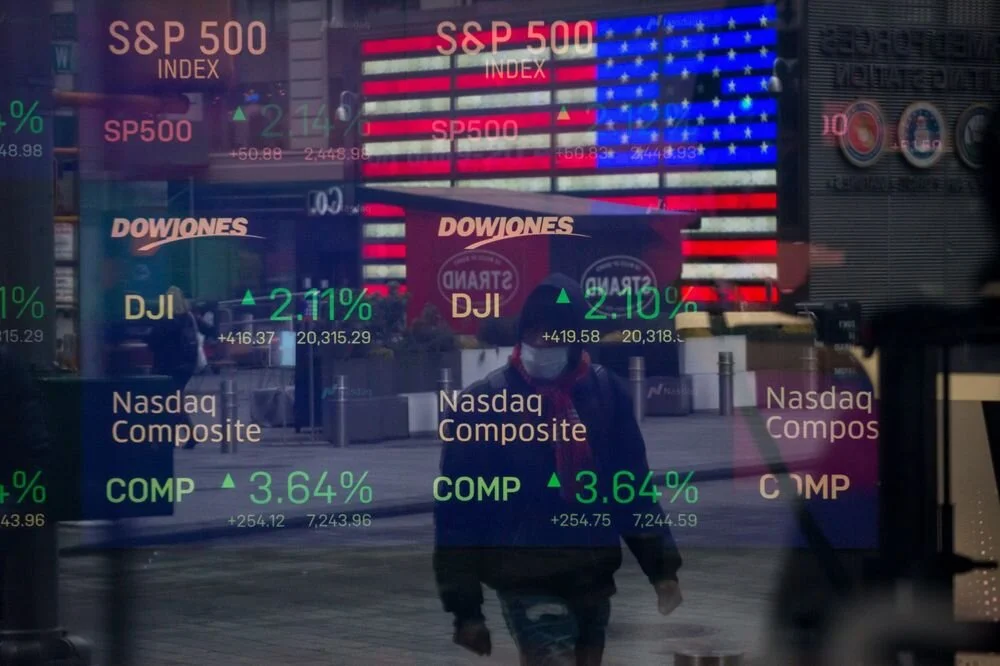

Markets Pause Losses, Dow Over 20k

Bailouts for the aviation industry are a hot topic right now. On one hand, companies like Delta are coming under fire for billions in stock buybacks over the last few years. On the other, commercial aviation is a huge part of North America's transportation infrastructure, and allowing it to crumble now would surely hamstring the post-Coronavirus recovery. A middle ground, bailouts from cash-rich private equity leviathans like Apollo Global Management, is an interesting scenario to think about.

Dow Falls Below 20K as Stimulus Packages Announced

Today, the Dow Jones Industrial Index fell below 20,000, a mark it first achieved on January 25th, 2017. To give you an idea of how dramatic this drop is, just six weeks ago "Dow 30k" hats were the hot commodity for millenials who wanted everyone to know that they work in finance. You can still buy those hats, although you can also buy "Dow 20k" hats at the same webstore and t-shirts that read "Panic at the Costco." Sometimes pop culture is our best market indicator.

Market Dives Despite Quantitative Easing

Yesterday, in a highly unusual Sunday meeting of the US Federal Reserve's Federal Open Market Committee, the FOMC announced a 100 basis point cut to its overnight target rate and $700 billion of quantitative easing. These extraordinary steps to provide liquidity and ensure continued functioning of the global financial system joined the Bank of Canada's decision to cut rates at an emergency meeting on Friday.

Dividend Yields at All-Time Highs

Market volatility is causing a sell-off in equities around the world. A combination of panic-selling from retail investors, margin calls, and forced redemptions is continuing to push stock prices lower and lower. Pushing stock prices lower has the effect of raising the yield on their dividends, which are listed on a dollars per share basis. We're seeing the dividend yields on some large-cap dividend-paying names reach extremely attractive levels, and we're reaching out with this opportunity.