Rates, Inflation, and Growth: An Update on the BoC and Fed for 2026

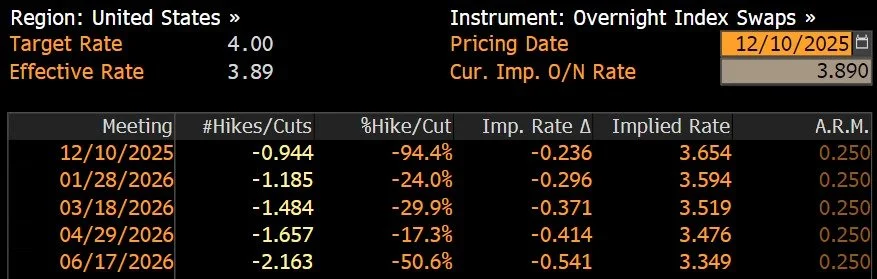

On December 10, both the Bank of Canada and the Federal Reserve released their monetary policy decisions. With the Canadian economy showing a bit more momentum through stronger-than-expected Q3 GDP and an improving employment picture, the Bank of Canada kept its target interest rate unchanged at 2.25%. In the United States, recent data have pointed to rising uncertainty, driven by higher unemployment and inflation pressures linked to tariffs. In response, the Federal Reserve lowered its target interest rate by 25 basis points to a range of 3.50% to 3.75%.

In Canada, inflation has continued to ease. As of October 2025, the consumer price index rose 2.2% on a year-over-year basis, down from 2.4% in September. The moderation reflects a drop in gasoline prices which helped pull down overall inflation. Grocery prices also rose more slowly, with food purchased from stores up about 3.4% over the last 12 months. Excluding gas, the CPI rose 2.6%. Core inflation remains a bit elevated, but has shown signs of stabilizing.

Consumer Price Index in Canada. Source: Bank of Canada, accessed on Dec 10, 2025

In the United States, inflation has been slower to ease. At the start of the year, annual CPI inflation was 3.0% in January, and by September - the most recent month with complete data - it remained at 3.0%. This persistence reflects several contributing factors. Food prices have continued to increase at a steady pace, adding pressure to household budgets. Tariffs introduced earlier in the year have raised the cost of many imported goods, which has kept price growth elevated in categories such as vehicles and electronics. Energy prices have also been volatile rather than consistently declining, limiting their ability to offset increases elsewhere. As a result, core inflation has stayed close to 3%, which is above the Federal Reserve’s 2% objective.

Consumer Price Index in the US. Source: U.S. Bureau of Labor Statistics, accessed on Dec 10, 2025

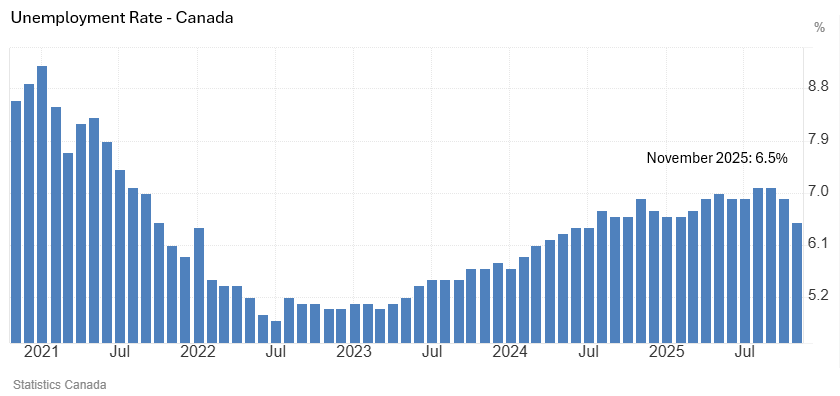

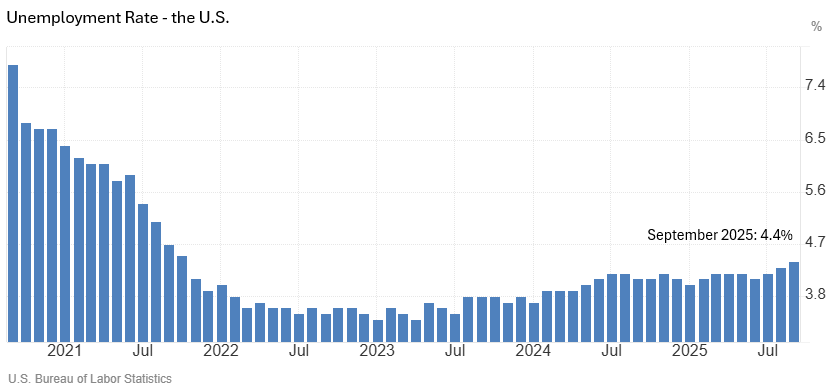

Turning to labour markets, conditions in Canada have shown modest improvement. Employment has increased over the past three months, bringing the unemployment rate down to 6.5% in November. The recent gains have come largely from service-sector roles, which have offset earlier weakness in trade-sensitive industries. In the United States, the unemployment rate stood at 4.4% in September, slightly higher than earlier in the summer. While this remains low by historical standards, several indicators point to a softer backdrop. Private payroll data suggest that hiring has slowed and that some sectors, particularly retail, leisure and hospitality, and manufacturing, have seen job losses in recent months, signaling that the labour market is becoming more uneven.

Canada Unemployment Rate. Source: Trading Economics, accessed on Dec 10, 2025.

United States Unemployment Rate. Source: Trading Economics, accessed on Dec 10, 2025.

On growth, the Canadian economy delivered a stronger-than-expected rebound in the third quarter, with GDP rising 2.6% on an annualized basis. This recovery followed a softer second quarter that was weighed down by weaker exports. The Bank of Canada noted that domestic demand was essentially flat, meaning much of the improvement came from trade components that tend to fluctuate from quarter to quarter. Looking ahead, the Bank expects net exports to pull back in the fourth quarter but anticipates a moderate pickup in 2026 as domestic spending firms and fiscal measures gradually support activity. In the United States, the most recent official GDP figures are for the second quarter of 2025, and markets are now waiting for the release of third-quarter results. Those figures will provide a clearer sense of whether the economy is stabilizing or losing momentum. The Federal Reserve emphasized that its future policy decisions will depend heavily on how growth evolves over the coming months.

Looking ahead to 2026, both central banks emphasized that their future actions will depend heavily on evolving economic conditions and incoming data. The BoC said it remains ready to act if conditions materially change, though its tone suggests it may keep rates on hold for some time. Many market participants now expect that rates could stay at 2.25% through much of 2026, with the possibility of a modest increase in the second half of the year if inflation or growth rebounds. In the U.S., the outlook is more uncertain given pronounced divisions within the Fed. While the median projection from Fed officials calls for one more quarter-point cut next year, some expect rates to remain flat or even increase in the second part of 2026. For investors, this suggests a period of data-dependent policy where markets will likely react sharply to each major economic release - inflation, employment or growth.

World Interest Rate Probability - Source: Bloomberg - December 10, 2025

If you would like to discuss how these developments could affect your portfolio, please contact us at 604.643.0101 or cashgroup@cgf.com.

Book a meeting today with our of our advisors: https://calendly.com/cashgroup-cgf

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!