From Aaa to Aa1: What Moody’s Downgrade Signals About US Fiscal Health

On Friday, May 16, 2025, Moody’s downgraded the United States’ long-term credit rating from Aaa to Aa1. The decision was based on concerns surrounding the country’s rising debt levels and ongoing fiscal deficits. This marks the loss of the U.S.’s final top-tier rating from the three major credit agencies, following earlier downgrades by S&P in 2011 and Fitch in August 2023. While Moody’s assigned a stable outlook, the rationale behind the downgrade reflects increased strain on the country’s ability to manage its debt sustainably, particularly in the context of higher interest costs and limited progress on fiscal reforms.

By the end of fiscal year 2024, the U.S. federal debt had reached approximately $36.56 trillion, with an annual budget deficit of $1.83 trillion—equating to about 6.4% of GDP. Moody's projects that, absent significant fiscal reforms, the deficit will widen to nearly 9% of GDP by 2035, driven by escalating interest payments and rising entitlement expenditures. Concurrently, the debt-to-GDP ratio is expected to surge to 134% by 2035, up from 98% in 2024. A significant contributor to this trajectory is the increasing share of federal spending consumed by mandatory programs and interest obligations, which are anticipated to comprise around 78% of total federal expenditures by 2035. This trend highlights the structural nature of the U.S. fiscal challenge, limiting policymakers' flexibility to respond to future economic shocks without resorting to additional borrowing.

Total Federal Debt - Source: US Government Financial Statements

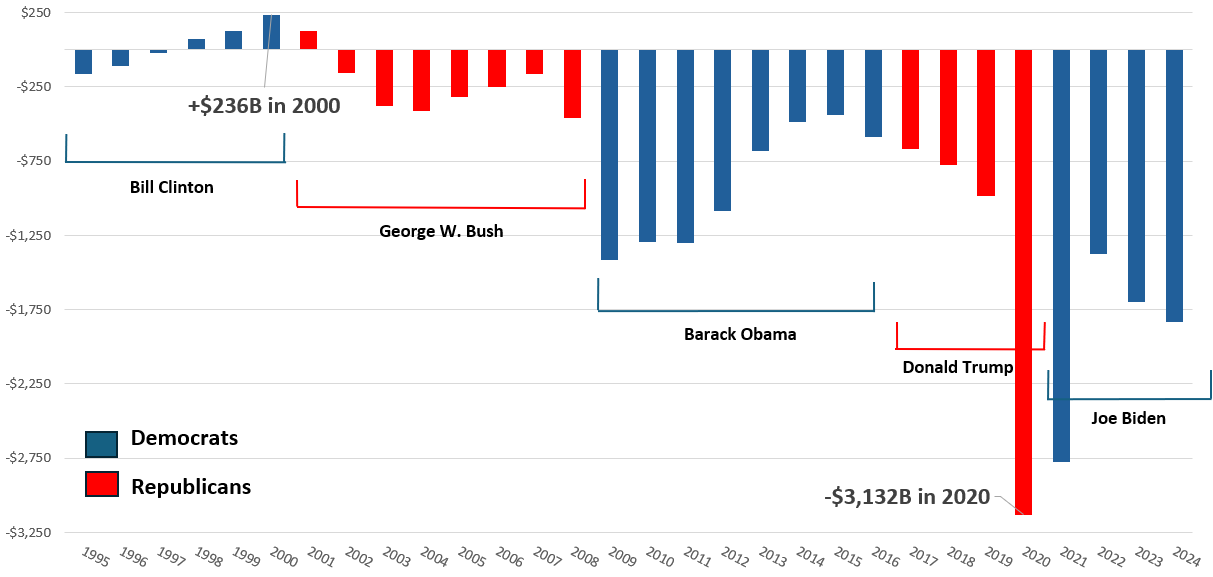

Annual Deficit/Surplus - Source: US Government Financial Statements

The market reaction to the downgrade was relatively modest. U.S. equity markets saw slight declines, with the S&P 500 falling 0.3% and the Dow Jones Industrial Average down by 0.2% on the day of the announcement. In the Treasury market, yields responded mildly, with the 10-year yield increasing up to 4.48%. This upward movement reflected a limited repricing of risk but did not indicate a significant loss of confidence in U.S. debt securities, which remain central to global financial markets.

Expectations around monetary policy were also influenced by the downgrade. Market participants appear increasingly convinced that the Federal Reserve will maintain its current interest rate stance in the near term. As of May 20, the probability of a rate cut at the upcoming June 18 FOMC meeting stands at just 5.3%, according to futures market data.

For a more detailed understanding or to address any specific inquiries, feel free to reach out to us at 604.643.0101 or cashgroup@cgf.com.

Market Updates

Our market commentary breaks down the latest business, financial and money news. If you’d like to receive all of our market update emails, send us an email by clicking the subscribe button. If you found this content helpful, share it widely!